FourQuants Learning Network is a subscription based online learning tool with topic-specific roadmaps covering Treasury, Risk, Corporate Governance and Compliance space.

The Learning Network evolved over the last 9 years through our learning practice based on feedback from customers in Treasury, Risk, Financial Institution, Corporate, Investment and Private banking teams. Most customers use it as a training platform for cross selling opportunities by bringing together customers, product ideas, treasury infrastructure and sales team.

Designed for clients with immediate learning needs where on-site live training is not an option on account of travel restrictions, budgets and scheduling conflicts.

Features

- Training content covering risk, pricing, market trends, trade ideas/execution, compliance, banking regulation, corporate finance, derivative products, treasury operations and asset liability management.

- Based on over a decade of risk, asset management and treasury product consulting experience in the Middle East, North America, Europe and South Asia.

- Addresses different levels of expertise through foundation courses for beginners to more advanced technical courses for quant professionals.

FourQuants Learning Network is a browser-based hosted facility providing affordable and convenient delivery of topic-specific content. The site is managed, updated and upgraded by our team, freeing you up from the headache of supporting a live actively used resource portal.

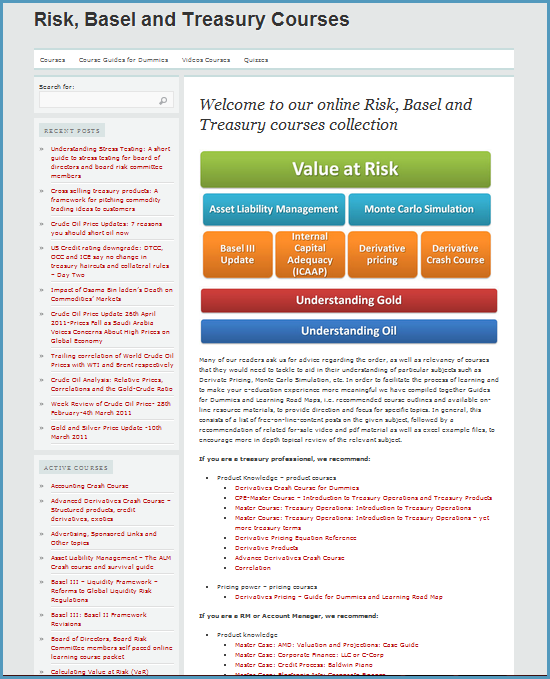

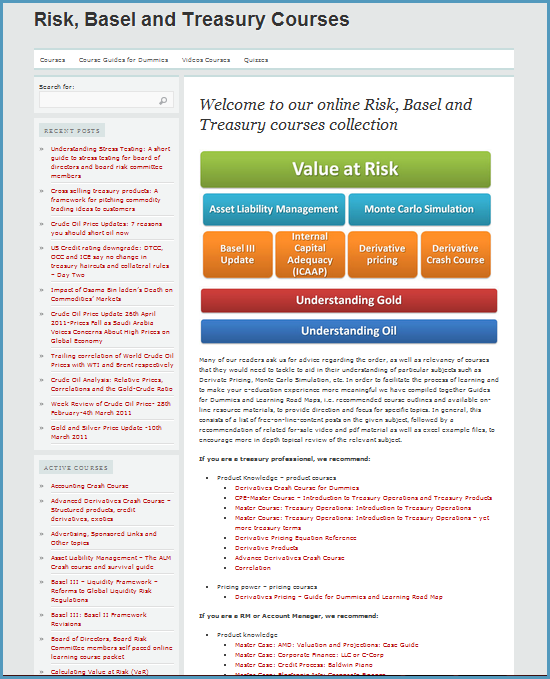

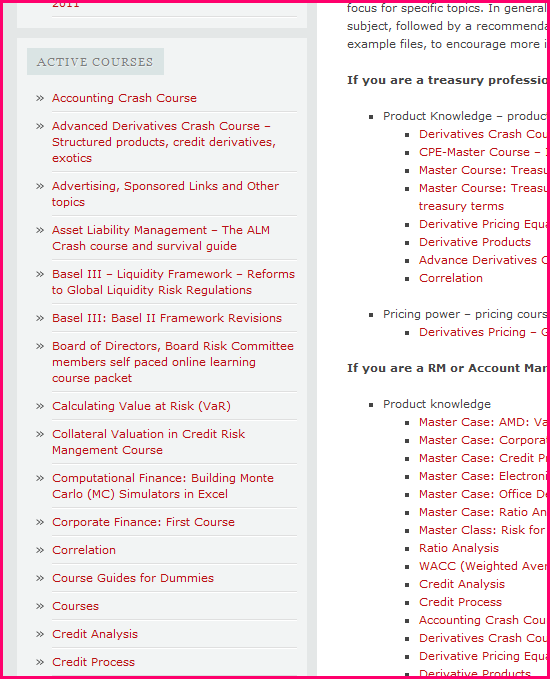

Catalogues the full range of our 40+ and growing inventory list of active courses, from basic topics such as an introductory course in corporate finance to more advanced level courses such as derivative pricing and interest rate modelling.

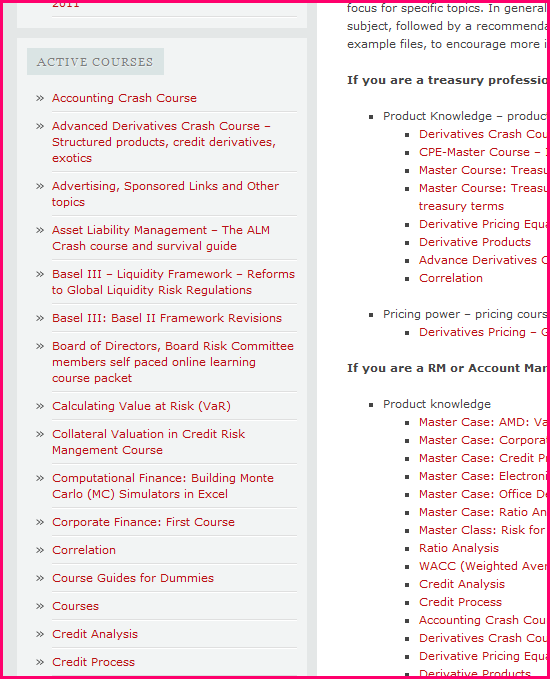

Custom role-specific recommendations and resources pertaining to our product-, risk- and pricing- related courses for various roles such as Treasury Professionals, Relationship or Account Managers, Senior Executives and Risk Managers.

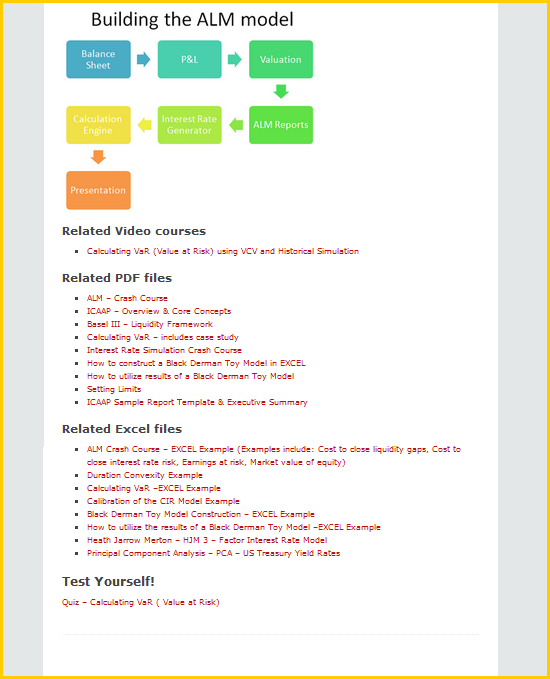

Suggests customized topic-specific learning roadmaps, written by subject matter experts, that provide necessary course learning focus and direction which aid in the process of understanding and mastering difficult or complex financial concepts. Roadmaps include html material, video courses, downloadable pdf notes and excel examples/ templates.

Contains video courses that walk through the subject on an one-on-one personalized basis. These cover an introduction to the subject, clarifying concepts, terminology and notation, discussions on more advanced topics within the subject and sessions that demonstrate the entire process of building custom excel spread sheets for various calculations and pricing/ valuation models.

Contains video courses that walk through the subject on an one-on-one personalized basis. These cover an introduction to the subject, clarifying concepts, terminology and notation, discussions on more advanced topics within the subject and sessions that demonstrate the entire process of building custom excel spread sheets for various calculations and pricing/ valuation models.

Content

You will get following video courses and topic guides at one flat price.

Online Course List

|

|

|

|

| Asset Liability Management – Course Outline |

|

- Section 1 – Definitions and Terminology

- Section 2 – ALM Risk Measurement Tools

- Section 3 – ALM Risk Examples and Applications

- Section 4 – Other Liquidity Risk Measurement Tools

- Section 5 – Liquidity Management

|

|

| Calculating Value at Risk – Course Outline |

|

- Section 1 – Introduction

- Section 2 – VaR methods

- Section 3 – Methodology

- Section 4 – Caveats, Qualifications, Limitations and Issues

- Section 5 – Comparing Value at Risk Models

- Section 6 – Applications

|

|

| Derivative Pricing – Basic – Course Outline |

|

- Section 1 – Terminology

- Section 2 – Products

- Section 3 – Option pricing using Monte Carlo Simulation

|

|

| Derivative Pricing – Advanced – Course Outline |

|

- Section 1 – Binomial Trees – Efficient Approach

- Section 2 – Convergence and Variance reduction techniques for option pricing models

- Section 3 – Pricing Exotic Options using Monte Carlo Simulation

- Section 4 – How to determine Spot Rates and Forward Rates & Yield to Maturity

- Section 5 – Advanced Fixed Income Securities

- Section 6 – Other Advanced Products

|

|

| Monte Carlo Simulation – Course Outline |

|

- Section 1 – Building Simulators in EXCEL

- Section 2 – Monte Carlo Simulation using Historical Returns

- Section 3 – Option Pricing using Monte Carlo Simulation

- Section 4 – Convergence and Variance Reduction Techniques for Option Pricing Models

- Section 5 – Further Applications

|

|

| Cross Selling Treasury Products – Course Outline |

|

- Cross Selling Treasury Product: 5 Core themes for our discussion

- Working through numbers – Introducing Value at Risk and PSR

- The Petrochemical Case Study: Estimating Client Exposure

- Core Treasury products and TMU customer reactions

- Derivative Crash Course: Vanilla and Exotics Derivative Contracts – A Quick walk through

|

|

| Option Pricing using Binomial Trees – Course Outline |

|

- Theoretical Overview of Derivatives and their Payoffs

- Option Pricing using the Conventional Binomial Tree Approach

- Option Pricing using the Efficient Tree Approach

- Pricing American Options & Exotics using the Efficient Binomial Tree Approach

- Increasing time steps and improving result accuracy using the Efficient Binomial Trees Approach

|

|

| Option Pricing using Monte Carlo Simulation – Course Outline |

|

- Black Scholes, N(d1) and N(d2), Monte Carlo Simulator – Theory and Model Review

- Monte Carlo Simulator – Basic Model Walkthrough

- Understanding N(d1) and N(d2) and Option Exercise using Monte Carlo

- Building a Monte Carlo simulator – Foundations

- Using data tables to store Monte Carlo simulation results

- Estimating errors and improving results accuracy

- Pricing Exotic Option using Monte Carlo

|

|

| Quant Crash Course – Course Outline |

|

- Risk & Context

- Value at Risk

- Capital – Learning to work with capital

- Limits

|

|

| Selling Derivatives Products – Course Outline |

|

Core Treasury products and TMU customer reactions

- Derivative Crash Course: Vanilla and Exotics Derivative Contracts – A Quick walk through

|

|

| Setting Value at Risk, Stop Loss, Pre Settlement and Counterparty Limits – Course Outline |

|

|

|

| Stress Testing – Course Outline |

|

- Introduction

- Stress Testing Framework

- Stress Testing Capital

- Introduction to Asset Liability Management

- Interest Rate mismatch & ALM

- ALM reports and extensions

- Value at Risk

- Capital – Learning to work with capital

- Evolution of Capital Adequacy requirements

- Review of ICAAP (Internal Capital Adequacy Assessment Process) & Basel II (III) – Liquidity risk adjustments

- Understanding Duration & Convexity

|

|

| Understanding N(d1) and N(d2) – Course Outline |

|

- Section 1 – Black Scholes, N(d1) and N(d2), Monte Carlo Simulator – Theory and Model Review

- Section 2 – Monte Carlo Simulator – Basic Model Walkthrough

- Section 3 – Understanding N(d1) and N(d2) and Option Exercise using Monte Carlo

|

|

Topic Guides

|

|

|

|

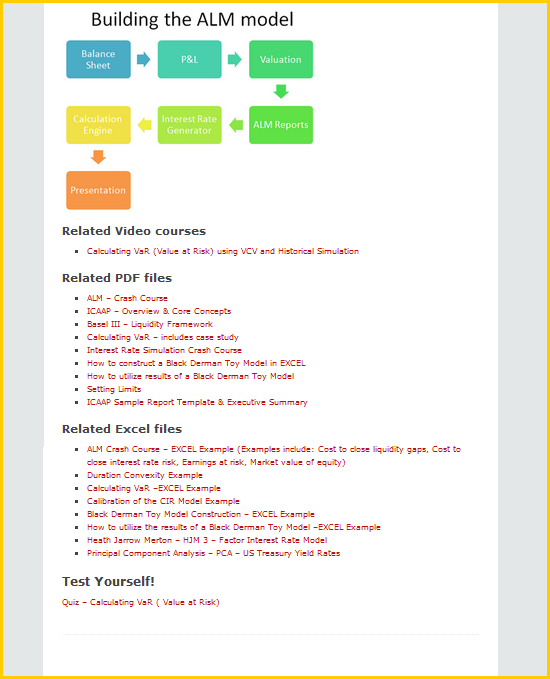

| Asset Liability Management (ALM) Crash Course |

|

PDF notes

- ALM Crash Course

- Value at Risk with Liquidity Premium

EXCEL Worksheets

- ALM Crash Course – Excel Examples [includes Cost of Close Liquidity Gaps, Cost of Close Interest Rate Risk, Earnings at Risk, Market Value of Equity]

- Duration Convexity Example

- Value at Risk with Liquidity Premium – EXCEL EXample

|

|

| Black-Derman-Toy (BDT) Interest Rate Model |

|

PDF notes

- How to construct a Black Derman Toy Model in EXCEL

- How to utilize results of a Black Derman Toy Model

EXCEL Worksheets

- Black-Derman-Toy Model Construction – EXCEL Example

- How to utilize results of a Black Derman Toy Model – EXCEL Example

|

|

| Basel & ICAAP |

|

PDF notes

- ICAAP – Overview & Core Concepts

- ICAAP Sample Report Template & Executive Summary

- Basel III – Liquidity Framework

|

|

| Calculating Value at Risk (VaR) |

|

PDF notes

- Calculating VaR – Includes case study

- Value at Risk with Liquidity Premium

EXCEL Worksheets

- Calculating VaR – EXCEL Example

- Portfolio VaR – EXCEL Example

- Value at Risk with Liquidity Premium – EXCEL Example

|

|

| Credit Analysis & Credit Process |

|

PDF notes

- Credit Analysis – First Course

- Credit Analysis – Financial Institution

- Credit Process

EXCEL Worksheets

- Credit Analysis – Financial Institution – EXCEL Example

|

|

| Derivatives Pricing |

|

PDF notes

- Derivative Pricing – Binomial Trees – Efficient Approach

EXCEL Worksheets

- Valuing Options – Black Scholes Example

- Valuing Options – Binomial Tree Example – Traditional Approach

- Derivative Pricing – Binomial Trees – EXCEL Example

- Pricing Ladder Options using Monte Carlo Simulation

|

|

| Derivative Products |

|

PDF notes

- Derivatives Terminology Crash Course

- Derivative Products

|

|

| Forward Prices and Forward Rates – Calculation reference & detailed examples |

|

PDF notes

- Calculating Forward Price and Forward Rates in EXCEL

EXCEL Worksheets

- Calculating Forward Prices, Rates, YTM & FRA Values

|

|

| Heath Jarrow Merton (HJM) Interest Rate Model |

|

EXCEL Worksheets

- Pricing IRS – Module I – Term Structures EXCEL Example

- Heath Jarrow Merton – HJM 3 – Factor Interest Rate Model

- Principal Component Analysis – PCA – US Treasury Yield Rates

|

|

| Interest Rate Simulation Crash Course |

|

PDF notes

- Interest Rate Simulation Crash Course

EXCEL Worksheets

- Pricing IRS – Module I – Term Structures EXCEL Example

- Calibration of CIR Model Example

- Black-Derman-Toy Model Construction – EXCEL Example

- How to utilize results of a Black Derman Toy Model – EXCEL Example

- Heath Jarrow Merton – HJM 3 – Factor Interest Rate Model

- Principal Component Analysis – PCA – US Treasury Yield Rates

|

|

| Monte Carlo Simulation |

|

EXCEL Worksheets

- Monte Carlo Simulation – Commodity – Example

- Monte Carlo Simulation – Currency – Example

- Monte Carlo Simulation – Equity – Example

|

|

| Monte Carlo Simulation with Option Pricing |

|

PDF notes

- Derivative Pricing

- Monte Carlo Simulation – Models and Applications

- Monte Carlo Simulation – Equity – Example

EXCEL Worksheets

- Supporting file for the alternate binomial tree methodology

- Option pricing using the Traditional Binomial Tree approach

- Option pricing using the Black-Scholes option pricing formula

- An example of how the Ladder call option may be priced using Monte Carlo Simulation in EXCEL

- Derivative Pricing using Monte Carlo Simulation (calculates the option prices for a number of vanilla and exotic options including Asian, Barrier, Lookback & Chooser Options)

|

|

| Pricing Interest Rate Swaps and Interest Rate Options |

|

PDF notes

- Pricing IRS – Module I – Term Structures

- Pricing IRS – Module II – IRS and CCS

- Pricing Interest Rate Options – Module III

EXCEL Worksheets

- Pricing IRS – Module I – Term Structures EXCEL Example

- Pricing IRS – Module II – IRS and CCS EXCEL Example

- Pricing Interest Rate Options – Module III EXCEL Example

|

|

| Setting Counterparty Limits |

|

PDF notes

- Setting Counterparty Limits

- Sample Counterparty Limit Proposal

EXCEL Worksheets

- Setting Limits – EXCEL Example

|

|

| Treasury Crash Course |

|

PDF notes

- Treasury Crash Course

- Value at Risk with Liquidity Premium

EXCEL Worksheets

- ALM Crash Course – Excel Examples [includes Cost of Close Liquidity Gaps, Cost of Close Interest Rate Risk, Earnings at Risk, Market Value of Equity]

- Duration Convexity Example

- Calculating VaR – EXCEL Example

- Value at Risk with Liquidity Premium – EXCEL Example

|