The “Crossing Selling Treasury Products” video course presents a framework for empowering client facing treasury teams to go out and cross sell high value, high margin trading concepts to clients. They do this by educating customers about their exposures and by presenting a range of available solutions that would help reduce the risk associated with these same exposures.

Course Prerequisites

Corporate Banking and Treasury products, Value-at-Risk (VaR) and counterparty limits.

Course Audience

This course is targeted at intermediate and advance users and is aimed at banking, corporate, treasury and sales teams, relationship and account managers that offer or present derivative products as part of their marketing and sales efforts and repertoire.

Course Guide

Here is the structure of the course.

|

Title

|

Duration

|

||

| Session 1 – Cross Selling Treasury Product: 5 Core themes for our discussion | 36:10 mins | ||

| Session 2 – Working through numbers – Introducing Value at Risk and PSR | 38:56 mins | ||

| Session 3 – The Petrochemical Case Study: Estimating Client Exposure | 24:29 mins | ||

| Session 4 – Core Treasury products and TMU customer reactions | 38:02 mins | ||

| Session 5 – Derivative Crash Course: Vanilla and Exotics Derivative Contracts – A Quick walk through | 43:22 mins | ||

Session One – Cross Selling Treasury Product: 5 Core themes for our discussion

There are 5 core themes to our discussion when it comes to commodity trading and trading ideas.

- Price

- Risk

- Value

- Products

- Limits

When engaging customers in discussions involving trading products and concepts, discussions generally revolve around one of the above themes. As a relationship or account manager if we are prepared to provide our recommendations based on a framework around one or more of these themes, the likelihood of the client understanding and buying the trade is higher. The framework is also useful in presenting analysis in a format that is logical and can be easily explained and digested.

The objective for using a framework is to work with clients across a range of product ideas and commodity markets. As long as there is broad agreement on the framework, the same trades can be applied across different markets.

Let’s take a look at each of these themes by one by one.

Price and Volatility

The difference between experienced and amateur traders is how we look at price.

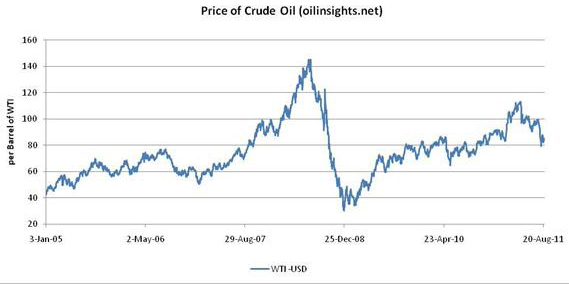

When I see a price graph (as an amateur trader) such as the one below for crude oil (WTI) prices from January 2005 to August 2011 my immediate assessment is based on a one dimensional view of prices. Price are high or low, relatively high or low, abnormally high or low. The dimension is price level. In mathematical terms we try and approximate single dimensions such as price using linear relationships.

But experienced traders look at price in more than one dimension. Rather than just looking at relative price levels they ask question about fundamental drivers of price as well as additional dimensions other than just price levels.

Session Two: Working through numbers – Introducing Value at Risk and PSR

What is Risk? A quick and dirty introduction to Pre-settlement risk limits.

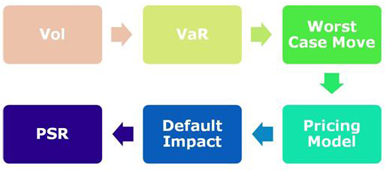

As a relationship manager we have to balance two points of views. What is the client’s exposure? What is his worst case loss without any intervention? A hedging or trading conversation cannot move forward unless this question is answered. How do these numbers change with intervention (ideally with the solution we have or are suggesting)? What happens to our balance sheet exposure if we help the client with these solutions? What happens if the client defaults and is not able to settle the exposure he has taken on with our products and solutions? To the client? To us?

The Pre-settlement risk limit estimates the above numbers by following a simple process. Using volatility it estimates the worst case possible price move (value at risk or var) and then estimates the value of the solution to the client and the bank at that level. It then evaluates the impact of a default if the client is unable to fulfill his commitment. Vol > VaR > Default Impact > PSR limit exposure.

Session Three: The Petrochemical Case Study: Estimating Client Exposure

Any effort to create a framework for managing risk should start by asking the following questions

- What is the metric that we use for measuring risk?

- How frequently do we monitor it?

- How sensitive is this measure to changing prices and market conditions?

- How is this sensitivity benchmarked or calibrated?

- Do we use our realized historical experience in this calibration exercise?

- What models do we use to predict the range of values for this measure in the future?

- How stable are these models?

- Under what conditions will these models fail or break down?

- What are the assumptions behind these models?

- What is included in the data set used to run these models?

- Do we have a pre-defined tolerance for movement in this measure on account of prices and market conditions?

- How is this tolerance calculated? Who reviews and approves it? How frequently?

- How does this tolerance relate to expected loss? How does expected loss relates to actual capital that needs to be set aside to support this tolerance?

- Are there any policies and processes in place that document the answers to these questions?

- How frequently are these policies and processes reviewed?

- How do we measure the effectiveness of these policies in controlling the risk metric that we are tracking

A first look through the above questions allows us to classify them in the following categories.

- Policy

- Data

- Models

- Metrics and sensitivities

- Limits & Tolerance Levels

- Process and Control

Session Four: Core Treasury products and TMU customer reactions